Buying a Franchise vs. an Independent Business

By Mainshares

Jul 18, 2024

In Buying a Business

Franchises are a great option if you want to de-risk as a small business owner. The franchise group typically provides a number of valuable services: a training program for new owners, access to a built-out supply chain, managed marketing campaigns, and territory oversight. You may also benefit from the goodwill other owners have earned in their respective markets.

However, the services franchisors offer come at a cost to the franchisees–after all, franchisors need to make the franchise play worthwhile. Moreover, ongoing services fail to address a key set of questions that arise at the very onset: will the new franchise owner be able to hire strong employees? Will the local market be receptive to the franchise? How can the franchise stay nimble while still adhering to the rules and regulations of the franchise?

There’s a convenience factor in handing over a lot of the operational reins to the franchise. But there’s also a risk if things go south for the group and your franchise gets associated with mismanaged locations. How do you gain the benefits of business ownership while still setting yourself up for success as an owner? We believe the answer is to buy an independent small business.

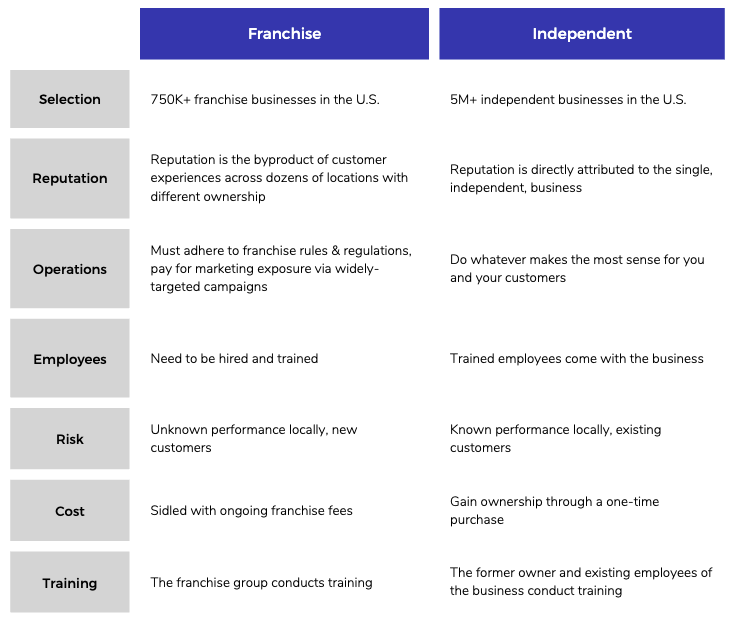

Buying a Franchise vs Buying an Independent Business

Selection: While franchises exist for almost any type of business, there’s a far greater volume and variety of independent small businesses. Moreover, many independent businesses are stalwarts in their communities and have a customer base they’ve built up over decades.

Reputation: The franchise's reputation is not a function of one location alone. This can be incredibly beneficial for driving initial business, as the new franchisee can piggyback off the goodwill and brand awareness of other locations. However, it also means the franchisee doesn’t have full control over the customer experience, and negative experiences at other locations can harm your business. When you buy a small independent business, the business's reputation is yours and yours alone.

Operations: Franchises are great because you’re plugging into a proven business model (as you are with an independent business), but franchises are infamous for enforcing rules to maintain a consistent brand. While these rules are beneficial to protect the brand, they can also prevent you from capitalizing on opportunities in your market.

Employees: We continue to operate in one of the most difficult job markets. There’s been a sharp fall in the unemployment rate since the beginning of COVID-19 to the point where we now find ourselves at a record-low unemployment level. This means owners need to compete fiercely to attract quality labor. And if you’re planning on launching a franchise, you’ll be starting from scratch regarding the most important business input: high-quality labor. On the other hand, acquiring a small business almost always means you’ll have at least a few employees right out of the gate–many of whom are highly skilled, have customer relationships, and are much more of a known commodity than new hires.

Risk: The major attraction of franchises is they help owners reduce risk. This comes in several ways: the business model has been tested and proven in other markets, there’s an existing customer base that may patronize other locations (or at least help with brand awareness), there are processes in place to access critical inputs like inventory, and there’s a brand and marketing machine the new owner is tapping into. Of course, all the help de-risking gets passed along to the franchisee through fees. Independent businesses also operate on proven business models. Additionally, many independent businesses have been around far longer than similar franchises, are known (and loved) in their communities, and have a reserve of loyal customers to prove it.

Cost: While it’s true that franchisors are incentivized to enable success from franchisees, they’re also looking to make money: setup costs, mandatory equipment with generous margins built in, inventory minimums, marketing fees, franchise royalties–it’s all on the table and almost always binding. Independent businesses are much more flexible. Financing is negotiable and can even be used to help ensure a smooth handoff, as with seller notes.

Training: Franchises will always sell you on their training programs. To be fair, these programs can be quite good. Franchise groups know they need to adequately empower new franchisees to keep the flywheel spinning for expansion. This is why the good franchise groups have invested heavily in training programs. However, these programs cater to the lowest common denominator franchisee and can sometimes be theoretical. In contrast, training for independent businesses is conducted on the job with actual employees and customers. The previous owner holds paper in the form of a seller note to make sure interests are aligned, and the full value of the business is passed off to the new owner.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Get the latest in your inbox

Join our monthly SMB newsletter. It's free and not annoying.

This website (the “Website”) is owned and operated by Mainshares, LLC (“Mainshares”). By accessing the Website and any pages thereof, you agree to be bound by Mainshares’ Terms of Service and Privacy Policy, as well as the Terms of Service and Privacy Policy for Main Street Securities, LLC (“Main Street”). The information contained herein is provided for informational purposes only and is not intended to influence any investment decision or be a recommendation for any investment, service, product, or other advice of any kind, and shall not constitute or imply an offer of any kind. The products and services offered by Mainshares are not offered by a certified public accountant (“CPA”) and should not be considered as a substitute for services provided by a CPA.

The information contained herein is provided by Mainshares, LLC (“Mainshares”) for informational purposes only and is not intended to influence any investment decision or be a recommendation for any investment, service, product, or other advice of any kind, and shall not constitute or imply an offer of any kind. The products and services offered by Mainshares are not offered by a certified public accountant (“CPA”) and should not be considered as a substitute for services provided by a CPA.

Broker-dealer services provided in connection with some of the investment opportunities on the Mainshares platform are offered through Main Street, a registered broker-dealer, affiliate of Mainshares, and member of FINRA/SIPC. For additional information, please contact your licensed securities representative of Main Street Securities LLC or visit FINRA’s BrokerCheck. If the investment opportunity does not include the "Brokered by Main Street Securities" designation, broker-dealer services were not provided in connection with the offering through Main Street.

Neither Mainshares nor Main Street Securities LLC make investment recommendations and no communication, through this Website or in any other medium should be construed as a recommendation for any security offered.

Should you be presented with an investment opportunity, such investment opportunities involve private, unregistered securities that are speculative and involve substantial risk. These investment opportunities are conducted in accordance with an exemption from registration, specifically relying on the private offering provision outlined in Section 4(a)(2) of the Securities Act of 1933, along with compliance with Rule 506 of Regulation D. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is always potential to lose money when you invest in securities or other financial products. Private placements lack liquidity and distributions are not guaranteed. You are strongly encouraged to seek professional advice prior to entering into any transaction for any securities and to consider your investment objectives and risks carefully before investing.

Neither the SEC nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided herein or through any references/links herein. There can be no assurance that any valuations provided by issuers are accurate or in agreement with market or industry valuations. Neither Mainshares nor Main Street Securities LLC make any representations or warranties as to the accuracy of such information.